Morning Note - 7/15/25

Below is a snippet of commentary from Bespoke’s daily Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Bespoke’s Paul Hickey discussed markets heading into earnings season on CNBC yesterday. You can view the segment here.

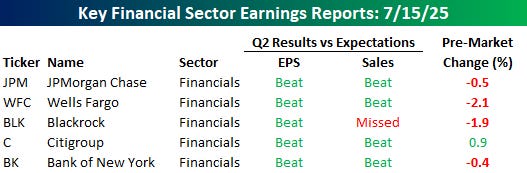

It’s taken long enough, but the Q2 earnings season is finally here with several large banks, including J.P. Morgan Chase (JPM), reporting this morning. Of the reports we’ve seen so far, the results have generally been good, with five companies beating EPS forecasts and four topping consensus forecasts for sales. In response to the positive reports, though, four of the five stocks are trading lower. The magnitude of the declines has been very modest, and it’s still early, but the negative reactions could be a signal that investors have high expectations heading into earnings season.

While investors are taking a sell-the-news reaction to this morning's results, futures for the S&P 500 and Nasdaq are both higher heading into this morning's CPI report. The positive tone in futures stems from an announcement from Nvidia (NVDA) that it would resume sales of its H20 chips in China. In Europe this morning, markets are little changed, with the STOXX 600 up 0.2% while equities were mostly higher in Asia overnight.

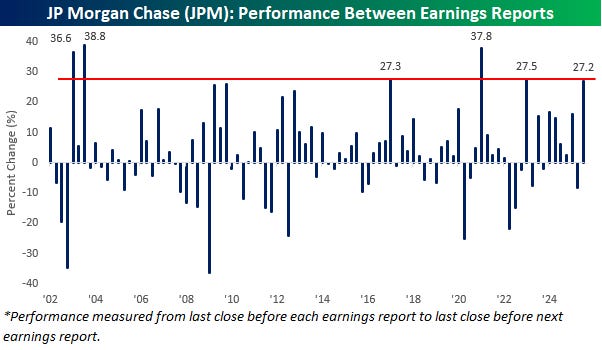

In yesterday’s CNBC segment, we discussed how the expectations bar is higher heading into this earnings season than it was last earnings season. To illustrate, let’s look at JP Morgan Chase (JPM). The chart below shows JPM’s performance from the close before one earnings report to the close before the next. Heading into today’s report, JPM had rallied 27.2% since the close before its last earnings report, and that ranks as the sixth-best performance between earnings reports since at least 2002 and the best since the three months leading up to its January 2023 earnings report. During Covid, JPM rallied 37.8%, and there were two quarters following the dot-com bust when the stock also rallied by more than 35%.

Just because JPM has rallied a lot leading up to this quarter’s report doesn’t mean it has to decline in the three months following its next earnings report. That being said, the stock’s median performance following periods when it had big gains leading up to one earnings report is lower than its performance following all other earnings reports. Of the nine prior periods when the stock rallied more than 20% in the three months between earnings reports, JPM’s median performance between its next two earnings reports was a decline of 1.0% with positive returns 44% of the time. For all other periods when the stock was up less than 20% since its last earnings report, the median performance between its next two reports was a gain of 3.4% with positive returns 65% of the time.

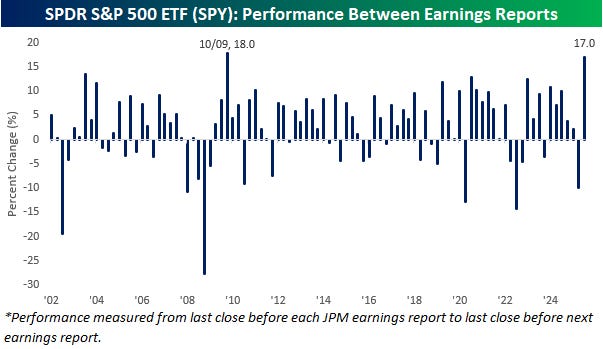

Since JPM typically reports very early on in earnings season, the chart below shows the performance of the SPDR S&P 500 ETF (SPY) between JPM reports since 2002. While the last three months have been the sixth-best period between earnings reports for JPM, in the case of SPY, its 17.0% has been the second-best. The only period between JPM reports that SPY performed better was leading up to its October 2009 report, when it rallied 18.0%. Based solely on the performance of SPY between JPM reports, the bar is higher heading into this current earnings season (with SPY up 17% over the last three months) compared to the 9.9% decline in the three months leading up to last April’s report. That decline was the sixth worst since at least 2002.

Want to see more in-depth analysis like this from Bespoke? Visit bespokepremium.com and check out all of our services for investors.