Bitcoin, IBIT Trounce Stocks

The iShares Bitcoin ETF (IBIT) has been the fastest-growing ETF of all time, eclipsing $70 billion in assets in less than 18 months and currently up to $85 billion. That's already big enough to rank it in the top 20 or so of the largest "mega-ETFs" in the US.

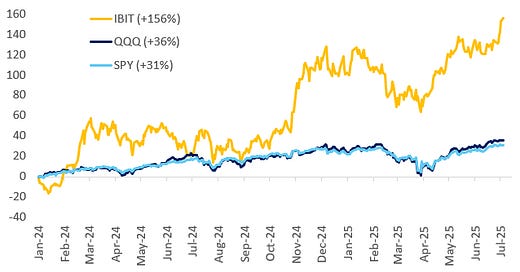

Since its closing price on launch day back on January 11th, 2024, IBIT is up 156%. That compares to gains of 36% for the Nasdaq 100 ETF (QQQ) and 31% for the S&P 500 ETF (SPY).

Compared to current S&P 500 stocks, IBIT's gain of 156% since it launched on 1/11/24 would rank 12th in terms of performance. There are eleven stocks in the index up even more than that, led by Palantir's (PLTR) gain of 794%. Other big winners since IBIT launched include Vistra (VST), Howmet Aerospace (HWM), Axon (AXON), NVIDIA (NVDA), Tapestry (TPR), Royal Caribbean (RCL), Coinbase (COIN), and Netflix (NFLX). There are 21 stocks in the S&P up more than 100% since IBIT's launch in early 2024, while the average stock in the index is up 26.1%.

Bitcoin prices were in the mid-$10,000s back in November 2022. Since its low point during that month, Bitcoin is up 668%. We also looked to see how that gain compares to the best-performing S&P 500 stocks over the same time frame. As shown below, just four stocks in the index are up more than Bitcoin since its 2022 low: Palantir (PLTR) -- up nearly 2,000%, NVIDIA (NVDA) -- up nearly 1,000%, Coinbase (COIN), and Vistra (VST). Another four stocks are up more than 400% over the same time frame: Meta (META), Super Micro (SMCI), Royal Caribbean (RCL), and Broadcom (AVGO).